SOUTH WHITEHALL TWP., Pa. — Parkland residents likely will have to pay more in taxes next year.

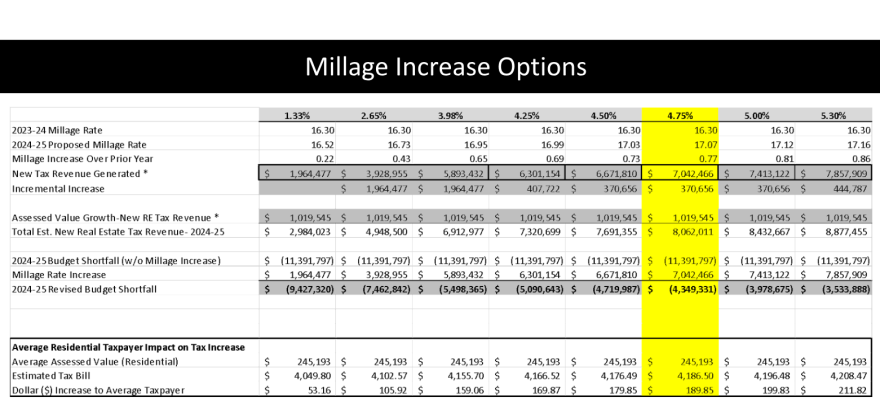

Parkland School District administration presented a proposed budget Friday with a property tax rate increase that would take the millage rate from 16.30 mills to 17.07 mills — a 4.75% increase.

The average taxpayer would have to pay about $190 more in taxes next year with that proposed increase.

That percent increase would be almost double what it was last year.

And the majority of school board members at the seminar indicated they thought a higher increase was needed because of building projects and increased enrollment.

Even with the 4.75% tax increase, the budget shows a deficit of about $4.35 million, which will need to be taken from the district’s fund balance, or its reserves.

“I don't think we have enough at 4.75%. I would go to the max" of 5.3%, board member Chris Pirrotta said.

"And I would do that with the very clear communication that even with going to max, we're still struggling with our growth.”

The maximum allowable yearly increase allowed by the state called the Act 1 index, is 5.3%.

Director of Business Administration Leslie Frisbie said that the maximum likely will lower significantly in coming years.

With that increase, the millage rate would become 17.16 mills, and the average resident would spend about $212 more. The deficit would be about $3.5 million.

“It's doable, but it's very, very painful and problematic."Superintendent Mark Madson

If the budget passes with the highest allowable tax increase, the district still would have the lowest millage rate in the county.

The second-lowest is Southern Lehigh School District, which currently has a 17.26 millage rate.

Board Director David Ellowitch asked Superintendent Mark Madson what it would take to lower expenditures in the current budget.

Madson said the district would likely have to cut staff, increase its class sizes and cut programs.

“It's doable, but it's very, very painful and problematic,” Madson said.

Why now?

Parkland residents had low tax increases for many years.

Last year’s tax increase, at 2.5%, was Parkland's highest in seven years. In several recent budgets, millage rates did not increase at all.

But recent enrollment projections showed the district’s middle and high schools exceeding capacity in the coming decade.

There have been many proposed housing developments in the Parkland area, such as Sunset Orchards in Upper Macungie Township and the controversial mixed-use development Ridge Farms in South Whitehall Township.

The residential developments will bring in new revenue, but there are also costs to accommodate the students, Board Director David Hein said.

“It’s not going to be offset one-to-one,” Hein said.

To address the issue, the district is in the process of building additions to Parkland High School and Orefield Middle School. It is also building a new operations center next to Orefield.

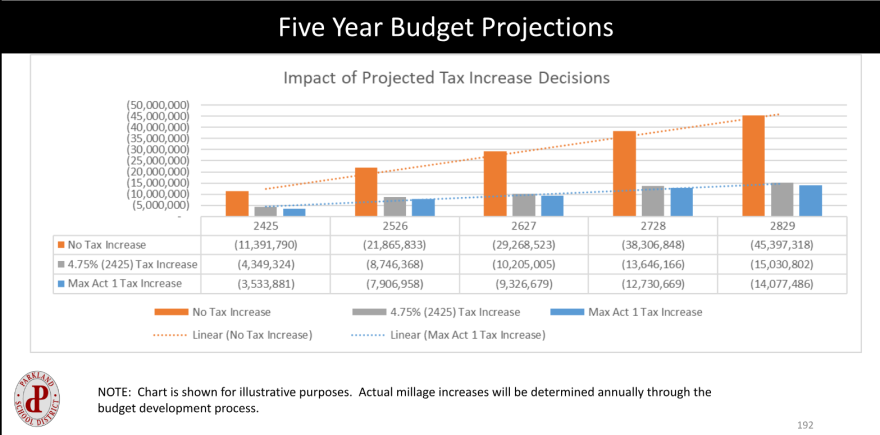

Frisbie showed in a chart that if the school board did not raise taxes, the district would quickly drain its fund balance in the coming years.

Frisbie also said there has been a slowed growth of the commercial and industrial sectors in the district’s municipalities, leading to a slowed increase of tax revenue from those sectors.

“What that does is… we need to come up with another funding source, and real estate tax increases is really where we can make that up,” Frisbie said.

‘Conscious of the impact’

Board President Carol Facchiano said she understands tax increases are difficult for residents.

“Any tax increase impacts me, just like it would my neighbor,” Facchiano said.

But she said she feels this budget will maintain the schools’ services as well as keeping a healthy fund balance.

"Everybody always says to us, ‘You have so much fund balance. Why don't we draw that down?’ Well guess what? We are."School Board President Carol Facchiano

“I don't want to leave the kids and the district in disarray five or 10 years down the road,” Facchiano said.

“And everybody always says to us, ‘You have so much fund balance. Why don't we draw that down?’ Well, guess what? We are. And then what are you going to do if you need that rainy day fund?”

Facchiano also said that drawing down the fund balance more would make it more expensive for the district to borrow money for its building projects.

Madson said he also understands that tax increases are difficult. But he said Parkland is not alone — districts across the state are struggling to keep up with increased costs.

He also said he thinks the district’s future plans will benefit the whole community.

“Some of the decisions and plans that we’re looking forward to will continue to add value to the community and additional spaces for community use, and continue to grow the district in a positive manner,” Madson said.

“But it doesn’t negate the fact that everyone at this table is conscious of the impact this has.”