(Second in the three-part series)

BETHLEHEM, Pa. - These are busy times at Community Action Lehigh Valley (CALV), which provides a host of housing services for homeowners and renters.

The volume of visits and calls is so high, Executive Director Dawn Godshall said, housing counselors had to put a halt on new rental assistance applications.

- A new survey finds nearly 8 in 10 Lehigh Valley adults are concerned about housing affordability

- A majority of residents (53%) rate housing "not so good" or "poor," the survey says

- The survey was conducted by the Muhlenberg College Institute of Public Opinion

Since the start of the pandemic, CALV has distributed almost $42 million in housing assistance but money for that program is now gone.

“Fair and affordable housing is a human right,” Godshall said. “[Housing] should not be dependent on any nonprofits. Cities and governments should all be working together to make sure that people have a place, an affordable place to live.”

A newly released quality-of-life survey by the Muhlenberg College Institute of Public Opinion shows an overwhelming majority of Lehigh Valley residents rate life here positively, with 86% of respondents describing it as either “excellent” or “good.”

But a substantial majority also have concerns — nearly eight in 10 residents worry about housing affordability in the region.

While most people had positive things to say about life in the Lehigh Valley generally, there was a clear sore spot: housing.

View the full experience: Life in the Lehigh Valley

A majority of Lehigh Valley residents (53%) rated the region’s housing negatively – either “not so good” or “poor.” That’s more than any previous survey dating to 2011 and significantly higher than the 19% who rated housing negatively the last time such a question was asked in 2018, said Chris Borick, a Muhlenberg College professor who conducts the surveys and directs the Institute of Public Opinion.

This comes as no surprise to people like Godshall and others who provide housing assistance. Rising housing costs, inflation and the COVID-19 pandemic have all combined to create what housing advocates describe as unprecedented pressure.

“These are working households, people needing two, or even three full-time jobs to be able to support themselves and live decently,” Godshall said. “We need people who are compassionate to understand that, you know, people are working their butts off. They’re not lazy, you know, sitting home and don’t want to work.”

Survey results

The survey was paid for by LehighValleyNews.com, the Lehigh Valley Economic Development Corporation and the Lehigh Valley Partnership. It polled 631 adult residents of Lehigh and Northampton counties by phone between Sept. 26 and Oct. 28, 2022.

Income levels showed to be a major factor in how people responded. Those with annual family incomes below $40,000 were nearly twice as likely (62%) to be very concerned with the affordability of housing than those with annual incomes above $80,000 (32%).

Race and levels of education were other factors in how people answered. People of color answered that they were “very concerned” (54%) more so than white respondents (40%), although both demographics (78% for each) answered they were either “very” or “somewhat” concerned.

People without four-year college degrees were more likely to be very concerned with affordable housing than those with a degree. Fifty percent of respondents without degrees said they were “very concerned,” compared to 34% with degrees.

Out of reach

Christopher Haring, 38, grew up in Easton and has lived in the Lehigh Valley for most of his life. Last year he moved from Bethlehem to Catasauqua because he says he was “priced out” of the city.

“I’m not opposed to home ownership, but it increasingly feels like it’s out of reach for somebody like me who isn’t real estate-minded, and wasn’t looking to make some investments,” said Haring, a freelance writer and researcher who has been renting homes since graduating from Kutztown University in 2006. “Do we want to invest in the outskirts of the Lehigh Valley when we’d rather live closer to the heart of the Lehigh Valley?”

Haring says he feels more “at home” in Bethlehem compared to smaller, more politically conservative places like Catasauqua, where he now lives.

“There’s nothing to keep us here,” he said.

He also said he believes there is not enough effort to develop places like Catasauqua as much as the region’s downtowns or urban hubs like Bethlehem.

"At the very least, I believe there is a very significant belief that the governments in these cities pay a lot of lip service but don't invest as much as they could in those types of areas,” he said.

Housing by the numbers

According to data from the Lehigh Valley Planning Commission, the median home sale price in the Lehigh Valley skyrocketed to $272,400 in 2022. That’s nearly $100,000 more than it was in 2009 (though the year before, with the 2008 financial crisis, the number spiked at $200,000).

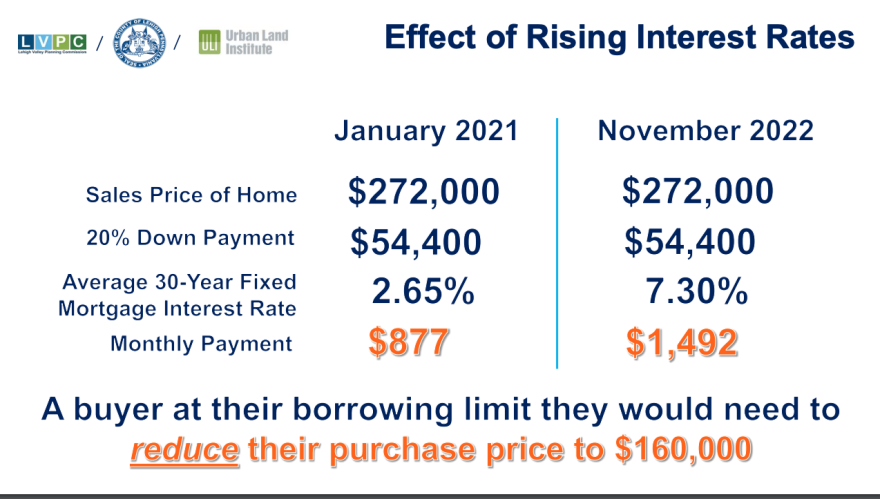

Rising values coupled with a series of interest rate hikes are having significant effects on home mortgages. According to the planning commission, a homeowner who put 20% down on a $272,000 house and took out a 30-year mortgage could expect a fixed rate of 2.65% at the start of 2021. That would require a monthly mortgage payment of $877.

By November of last year, however, the expected interest rate had jumped to 7.3%. Suddenly, a prospective homeowner using the same scenario would have a monthly payment of $1,492, according to the planning commission – an increase of 70%.

For renters in the Lehigh Valley, the median monthly rent was about $850 in 2010. By 2021 it was just under $1,200 – an increase of 40%, the data shows.

Even in cases where people can pay all their housing bills, there is a disproportionate number of “cost-burdened” households in the Lehigh Valley. The U.S. Census Bureau defines that as when more than 30% of household income goes toward paying rent, mortgage or other housing needs.

According to the planning commission, 76,881 households in the region – about 30% of the population – meet the definition of being cost-burdened. Twenty percent of homeowners and more than half of the renters (51%) fall into that category.

How we got here

From planners’ perspective, the housing situation is best described as a “shortage” that started in 2008 and has caused a surge in demand, and with it, price.

“With that housing downturn, the new construction of housing really dropped off,” said Jill Seitz, a senior planner at the Lehigh Valley Planning Commission. “And over the past 10 years-plus, it's really resulted in this huge housing deficit, and not exclusive to the Lehigh Valley. That's nationwide, too. But from what we've been looking at, the region has a shortage of over 90,000 housing units.”

Seitz said some have the perception that new, high-end or luxury apartments are a “net bad” for the housing situation in the Valley – but this is not necessarily true, from her perspective.

“The nature of new construction is that it will obviously cost more than units that are older and have been around for longer,” Seitz said. "Also – when there is a shortage of housing for higher-income Valley residents, the lower-income residents suffer – as the wealthier end up buying and renting homes affordable for lower incomes."

“So, new construction should help alleviate some of that pressure,” Seitz said, though she admits it isn’t an overnight or immediate fix.

It comes down to this: Waves of people are moving to the Lehigh Valley, and there aren’t enough places for them to live.

“Especially post-pandemic, people have a lot more flexibility in working from home, or only commuting a few days,” Seitz said. “So for a lot of people, they have the choice to live in New York City or move to a nearby area like the Lehigh Valley that has more open space and a lot more enjoyable, liveable character that people value.”

What's next?

Seitz said planning for population growth and designing municipalities to be able to accommodate it can help mitigate price increases.

“Communities should realize that their areas are going to grow regardless,” Seitz said. “So, you can strategically plan for how you’re going to accommodate that population increase.”

Without that, Seitz said, the increased demand will put a financial strain on communities designed to be lived in by fewer people.

View the full experience: Life in the Lehigh Valley

“Communities don’t have the option to say ‘We don’t want any change, but we want prices to stay the same,’” Seitz said.

In South Bethlehem, New Bethany Ministries provides shelter, housing assistance and transitional housing for people in need of a permanent place to live. Like Community Action Lehigh Valley on the other side of South Bethlehem, demand is high.

“What I’m seeing is too many people hearing the part where you need to build higher-income housing,” said Marc Rittle, New Bethany’s executive director. “And not enough people hearing the part where you also build lower-income opportunities.”

In Bethlehem, city consultants have been assessing the housing market and expect to recommend strategies for expanding affordable housing in a meeting next month.

Rittle said one of the solutions to the housing crisis involves forging partnerships. For example, New Bethany offers housing vouchers and assistance delivered directly through the organization as a proxy for those in need. It removes the burden of landlords relying solely on tenants who may or may not actually be able to make rent.

Unfortunately, Rittle said, landlords are not always eager to participate due to fears of loss of income – even though he says it’s not necessarily going to be the case.

“I never get a landlord calling me saying ‘Do you want to partner on the new building we’re constructing?’” he said.

Godshall, of Community Action Lehigh Valley, also takes the collective approach.

"I think we need to begin talking about it on a state and federal level, to see if there are rent controls or things that can be done that make more affordable housing for people.

"It's not any one entity's ability to do that. We all have to start working together so people can live life in a productive way, and be able to spend time with their families instead of spending hours working on end."

COMING TOMORROW: Race relations in the Lehigh Valley. Return to the full Life in the Lehigh Valley presentation here.