BETHLEHEM, Pa. — Owning a home is getting more expensive than ever, with new data showing monthly costs in the U.S. climbing faster than inflation last year, squeezing budgets and putting the proverbial dream of ownership further out of reach.

Challenges in Pennsylvania and the Lehigh Valley are even more evident, with housing reflecting a mix of aging stock, rising values and a growing divide between homeowners and renters.

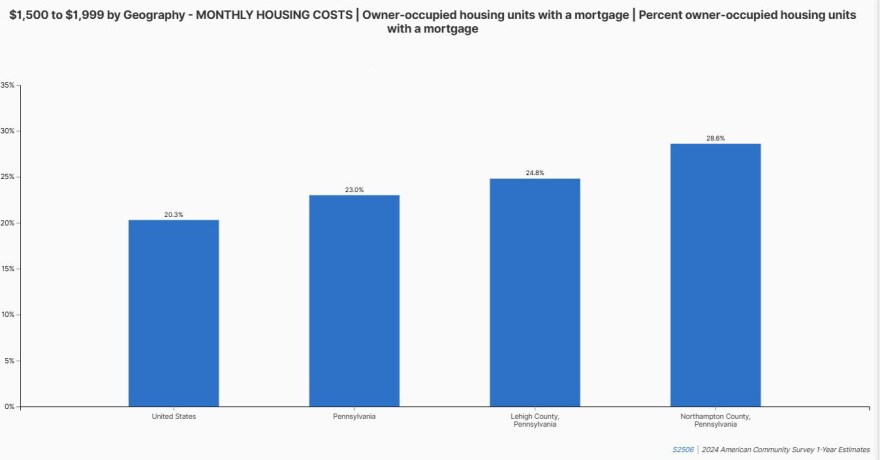

The data comes from the U.S. Census Bureau’s new American Community Survey, or ACS, 1-year estimates. It shows the median monthly owner costs for U.S. homeowners with a mortgage increased to $2,035 in 2024 from $1,960 (inflation-adjusted) in 2023.

"One way we measure housing affordability is based on how much households spend on selected costs such as mortgage payments, insurance, taxes, utilities, and various fees,” said Jacob Fabina, a Census Bureau economist, in a news release.

“In 2024, the median percentage of income householders with a mortgage spent on these costs was 21.4%, which points to an increased burden on homeowners."

At $1,775 monthly, Pennsylvania’s costs for homeowners falls below the national average, but costs in the Lehigh Valley are above the statewide average: Lehigh County came in at $1,953, and costs in Northampton County were at $1,886, the data shows.

For buyers, affordability remains a moving target, even after the Federal Reserve recently cut its benchmark rate for the first time this year.

“It’s two-fold when we get rate cuts,” said Michael Bernadyn, president of Greater Lehigh Valley Realtors.

“Anytime interest rates kind of go up or down, you know, whenever they go down, it gets a lot of people off the sidelines. But the other end of that is it does bring more buyers to the market.

“And in a market where we are squeezed with inventory, there's no ands, if or buts about that, our inventory levels are still very low, and it's frustrating, you know, it's very frustrating for the home buyer.”

Ownership vs. rental

Across the state, 5.3 million housing units are occupied, with about 69% owned and 31% rented, according to the ACS.

In the Lehigh Valley, data showed ownership remains strong, though renter households make up a significant share: 35% in Lehigh County (50,477 units) and 28% in Northampton County (34,257 units).

Still, the path to ownership looks different than it once did. Bernadyn said today’s buyers often have to be more prepared — and willing to bring more cash to the table.

“In years past you used to be able to see like an FHA buyer or VA buyer even, and potentially even some of these USDA loans, where that's zero down technically,” Bernadyn said.

“[But now] we’re seeing the buyers having to bring more cash to the table. We're not seeing the ones that are kind of, ‘Hey, you know what? We just decided we're going to buy a house, and we contacted ABC mortgage, and they got us a loan.’

“Basically that's really what we're seeing, that more informed buyer.”

Home values and incomes

Statewide, most homes are valued between $100,000 and $499,999, with only 2.7% reaching $1 million or more. In both Lehigh and Northampton counties, homes are skewing higher in value.

At the same time, incomes aren’t always keeping pace. Roughly a third of households in both counties earn $150,000 or more, while a small but notable share — about 1.5% — report incomes under $10,000.

Bernadyn said that dynamic is shifting the age and profile of the typical buyer.

“I think, what did the National Association [of Realtors] say? They said the average age is 38 for the first-time home buyer,” he said.

“So what that screams to me … is the pure basis that people are renting and they're in these rentals, but as they're in these rentals … somewhere along the lines, they are getting the information of, hey, I need to start saving money for the down payment.”

Aging housing stock

Much of the Valley’s housing is older. Nearly a quarter of Lehigh County homes (23.8%) and more than a quarter of Northampton County's (25.8%) were built before 1940, the ACS showed.

Only around 2% of homes in each county were built in 2020 or later, underscoring limited new construction compared with demand.

"Seller disclosures I don't think ever have been more important than they are now, to understand what is a home and what is this home."GLVR President Michael Bernadyn

Bernadyn said buyers recognize the challenges of older homes — but also the importance of understanding exactly what they’re getting.

“There are some concerns with aging homes, upkeep. Seller disclosures I don't think ever have been more important than they are now, to understand what is a home and what is this home,” he said.

“You probably know things like slate roofs … that's a dying art form, unfortunately. But yeah, it's those things. So I think the information end has been the most staggering increase or requirement that many buyers are looking for.

“I mean, we are in the information age, right? Public tax records are out there everywhere. Anybody can look up the tax records. However, when a buyer is coming to me as a Realtor, we are here, and it's diving in. Get the seller's disclosure. Where are we looking at when we see the home? What are we visually looking at and seeing?

“Home inspections have never been more important than they are now,” Bernadyn said, while calling seller disclosures “a crucial part of our current climate.”

Market outlook

Despite affordability concerns, demand in the Lehigh Valley remains strong, with homes often selling quickly if priced right.

“It's a mixed bag,” Bernadyn said of inspections and other contingencies. “We're still seeing multiple offer situations. We're still seeing those home values go over list price … but there are more homes sitting out there that are doing price reductions … and then that's where we're seeing those home inspections come back into play.”

Heading into fall, he expects the median sales price — which most recently hovered around $350,000 in the Lehigh Valley — to hold steady or even tick upward.

“If I pull out my crystal ball, yeah, I think we're going to see that potential little uptick,” Bernadyn said. “I don't envision it going below, especially that $350k mark … but I'll be honest, it's going to be interesting to see.”

Ultimately, he said, the Valley’s market remains defined by a mix of low inventory, strong demand and a housing stock that is both aging and highly valued.

“We were such an underappreciated market,” Bernadyn said. “And we jumped so fast that it was like a shock value for many. … I think we're going to see a leveling out playing out here more so."

As of Friday, the average 30-year fixed mortgage rate was approximately 6.23% to 6.25%.

“And I'm going to say I don't envision us jumping 20k-30k again, unless they drop rates to 2% or 3%. And I'll be honest, I don't want to see them do that. That's going to create even more chaos [if it does],” he said.