BETHLEHEM, Pa. — Even when real estate agents are guiding clients through the home-buying process, climate change comes up in conversation — even if it isn’t explicitly called out by name.

“Often, when I'm showing a house, if I see that somebody's got 5- or 6-inch gutters on their house, I'm pointing it out and saying, ‘That's excellent. Do you notice that they must have replaced their gutters recently?’” said Rebecca L. Francis, of the Rebecca Francis Team at Berkshire Hathaway Fox & Roach Realtors. “They've got six inch gutters on there, and that's really important right now, because we're getting so much more rain.’

“A bigger gutter is really a positive thing, because we want to keep water away from your house. Having that proper infrastructure is really important.”

The Lehigh Valley is experiencing more intense weather events each year, from deluges to droughts, due to climate change. As these conditions persist and even worsen, home-buying — already fraught with difficulty due to skyrocketing costs, while wages remain stagnant and inflation increases the everyday cost of living, making it harder to save for a down payment — has become harder to navigate.

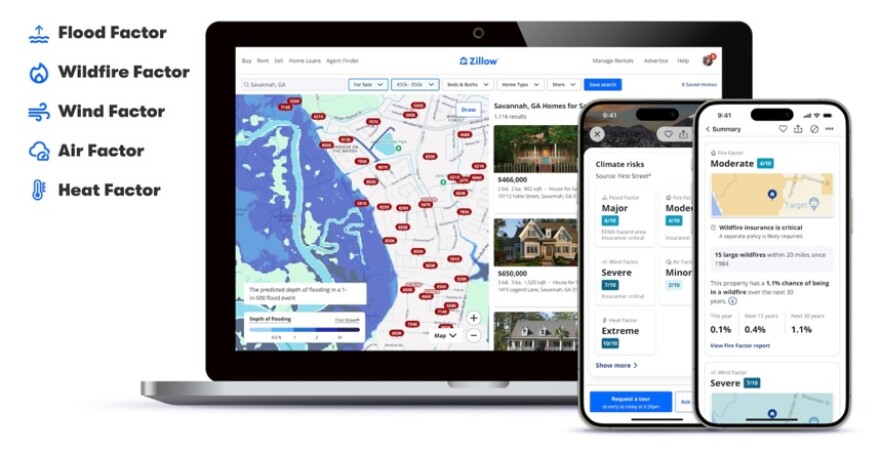

To highlight the climate risks homeowners might want to consider before buying,First Street, a climate risk financial modeling company, and Zillow have partnered to include a handful of climate risk factors on for-sale listings across the U.S. Announced in September and earmarked to be live by the end of this year, each on-sale listing will include the risk for flood, wildfire, wind, heat and air quality, as well as interactive maps and insurance requirements.

"Healthy markets are ones where buyers and sellers have access to all relevant data for their decisions."Skylar Olsen, chief economist at Zillow

“Climate risks are now a critical factor in home-buying decisions,” said Skylar Olsen, chief economist at Zillow, in a news release announcing the partnership. “Healthy markets are ones where buyers and sellers have access to all relevant data for their decisions.

“As concerns about flooding, extreme temperatures and wildfires grow — and what that might mean for future insurance costs — this tool also helps agents inform their clients in discussing climate risk, insurance and long-term affordability.”

Climate risks in the Lehigh Valley

The Valley has seen more than its fair share of extreme weather events attributed to climate change over the past few years.

Last summer, smoke from Canadian wildfires gave the region some of the worst air quality in the nation. At the time, the air quality in Allentown, Bethlehem and Easton was so bad that breathing outdoors was the equivalent of smoking more than 14 cigarettes.

But, even before the wildfire smoke, air quality had already been a point of contention because of the booming warehousing industry contributing to heavier truck traffic and increased emissions.

It's given the region a poor base air quality — the American Lung Association most recently graded Lehigh and Northampton counties at a “B” and “C” for particle pollution, respectively — and climate change is making it worse.

To learn more about the Valley’s air quality, officials launched the Lehigh Valley Breathes Project.

More than a year in, the project has yielded preliminary findings in line with what officials have speculated — that air quality varies by location, with higher concentrations of PM 2.5 recorded in high-traffic areas. And, fine particle pollution in the Valley is highest near warehouses and highways.

In mid-September, Allentown was named the asthma capital of the U.S. It’s not only the second year in a row, but the third time the Valley has topped the list. And, the new report comes just months after the area was ranked 11th for the most challenging places to live with pollen allergies.

Dramatic swings in precipitation, either too much or too little, have caused issues this year, too.

In January, schools were closed and rainfall records were set during a storm that caused thousands to lose power and sent emergency responders out to rescue drivers from the high water.

In August, the region saw heavy rain, leading to flash floods and prompting water rescues. The rainfall neared 5 inches in parts of the area, including the borough of Tatamy in Northampton County, which saw 4.91 inches.

Now, the U.S. Drought Monitor shows Lehigh and Northampton counties in extreme and severe drought, respectively. The state Department of Environmental Protection has declared a drought watch for both counties.

Dry conditions are credited with exacerbating the recent Blue Mountain brush fire, which scorched 600 acres for almost a week in Lehigh Township before it was fully contained.

More information, transparency

Adding climate change risks to on-sale home listings doesn’t come as a shock, said Eric Rehiling, treasurer of the Pennsylvania Association of Realtors. He volunteered with the National Association of Realtors on a committee called the Sustainability Advisory Group, and conversations about climate change have been ongoing.

“When our consumers have more information, there's more transparency about the property, and that's a good thing,” Rehiling said. “Particularly, I think where this can help is just helping our consumer understand what is the true cost of homeownership.

“Many times, we think about principal, interest, taxes and insurance. As a consumer, as a homeowner, we really want to understand that there's more that goes into buying a home besides that.”

Pennsylvania state law mandates homeowners complete a seller’s property disclosure.

“What has to be disclosed is known material defects on the property,” Rehiling said. “These are physical defects. They have to be physical defects, as opposed to something that could be extruded psychological, meaning it's haunted, or something like that — that's not in the disclosure.”

“Fannie Mae, like all the lenders, you have to report the flood map details and let people know whether or not a property is within a certain zone or not.”Bob Premecz, real estate appraiser

Water in the basement must be included on a disclosure, as well as if the property is situated in a flood zone.

Those disclosures can impact how costly homeowners insurance can be.

“The flood issue has always been a thing for competent appraisers,” said Bob Premecz, an area real estate appraiser. “Fannie Mae, like all the lenders, you have to report the flood map details and let people know whether or not a property is within a certain zone or not.”

The Greater Lehigh Valley Realtors Multiple Listing Service provides Flood maps to members, while Lehigh and Northampton counties also provide flood maps on their websites.

While flood data is something the Valley’s real estate agents and appraisers are familiar with, the other climate risks outlined in the new partnership — fire, wind, air quality and heat — will be new.

“Most appraisers don't consider these factors, because you're in the same climate,” Premecz said. “You're not doing one property in Florida and one property in Maine.

“Or, the air factor is location, location, location — the air quality of one house versus another house a few blocks away is not going to be changing.”

Home insurance used to be a “sure thing,” Francis said.

“You weren't really worried about somebody getting insurance,” she said. “But we're coming across more and more issues, like with an older roof. It might not have any issues, but it's older, so they don't want to insure it, or the insurance company will say, ‘Forget it. You've got to put on a new roof, or we won't insure it.’

“That's what we're seeing in our area.”

While climate risk information is good to have, it might be more pressing in other regions of the U.S., she said.

“In certain areas of the country, you're going to see a prevalence of wildfire issues, or the wind or the heat,” Francis said. “That's gonna be more important in other areas — not here quite as much.”

‘A benefit’

When the Zillow and First Street initiative is up and running home shoppers will see a new climate risk section.

“This section includes a separate module for each risk category — flood, wildfire, wind, heat and air quality — giving detailed, property-specific data from First Street,” according to the release. “This section not only shows how these risks might affect the home now and in the future, but also provides crucial information on wind, fire and flood insurance requirements.”

Each risk will be color-coded, complete with its own color scale.

While the information can be helpful, realtors said, a few were skeptical it would make a difference for the home market in the Lehigh Valley.

“The state, and Greater Lehigh Valley in particular, is not susceptible to a lot of these natural disasters,” Rehling said. "I'm not saying it can't happen. Obviously, we can never predict that.”

"Now they understand, ‘That home might be cheaper, but my cost of ownership might be a lot more expensive by the time I calculate in homeowners insurance, the cost of potentially rebuilding my home because of a natural disaster.'"Eric Rehiling, treasurer of the Pennsylvania Association of Realtors

However, it might make a difference for those considering moving states.

“Let's say the Greater Lehigh Valley, their price point might be x, and you're looking at another state,” he said. “Now they understand, ‘That home might be cheaper, but my cost of ownership might be a lot more expensive by the time I calculate in homeowners insurance, the cost of potentially rebuilding my home because of a natural disaster.’

“So, I think for our area, it's a benefit.”

Plus, adding more information to an already complicated and confusing process — especially for new homebuyers.

“Our job as realtors — we're not an insurance company or agent, we're not lawyers,” Francis said. “We're a lot of things, but we're not geologists.

“ … We're just trying to make sure that our clients have as much information as they can possibly have in order to make informed decisions.”